ATTENTION: Learn how to protect your savings. Contact us today! LEARN MORE

Medicare

There are many plans and options, and it

isn't always clear which ones are best for

you. Lyfe Advisors will make Medicare

simple for you.

What is Medicare?

Medicare is the federal health insurance program that provides coverage for people age 65 or older. Individuals under 65 can also qualify for Medicare if receiving Social Security Disability Insurance (SSDI) for a certain amount of time or if diagnosed with End-Stage Renal Disease. This coverage is standardized by the federal government and run by The Centers for Medicare & Medicaid Services (CMS).

Learn more about the basics of Medicare by watching the video below.

Arizona Medicare Plans

Original Medicare has two basic parts, Part A and Part B. Original Medicare alone offers limited prescription drug benefits. You may select a stand-alone Medicare Private Drug Plan (PDP) to cover these costs. Medicare Prescription Drug Plans are available through private insurance companies that contract with Medicare. These drug plans are also known as Medicare Part D and are optional.

As an Arizona resident, you have many different options available when it comes to your Medicare coverage. You can choose to get your Medicare Part A and Part B coverage through a Medicare Advantage plan (also known as Medicare Part C). Advantage plans are available through Medicare-approved private insurance companies. These plans are federally regulated and must cover at least the same level of benefits as Original Medicare. Many of these plans include additional benefits such as prescription drugs, health wellness programs, and routing coverage of dental, vision, and hearing.

Medicare Advantage plans in Arizona may have different costs than Original Medicare, and the specific benefits available will depend on your county and zip code. You still have Medicare if you enroll in a Medicare Advantage plan. Meaning that you will still owe monthly premiums for Part A and Part B as well as any Medicare Advantage plan premium.

Tip!

There are two main ways to get your Medicare coverage: Original Medicare (Part A and Part B) or a Medicare Advantage Plan (Part C). You may select additional coverage including a Medicare prescription drug plan or Medicare Supplement Insurance (Medigap).

Use these steps to help you decide what coverage you want:

Step 1

Decide if you want Original Medicare or a Medicare Advantage Plan (Iike an HMO or PPO)

‣ You may choose Original Medicare.

‣ You may choose a Medicare Advantage Plan.

Decide if you want supplemental coverage with a Medicare Supplement.

Step 2

Filling the coverage gap

You may have heard of the Medicare coverage gap (also called the "donut hole") but are unclear on what it means. After your Medicare Part D coverage has paid a certain amount for prescription drugs, you may have to pay all costs yourself up to a yearly limit. This temporary limit on what your Medicare Prescription Drug Plan will pay for covered drugs is the coverage gap. The coverage gap applies to both stand-alone Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug Plans.

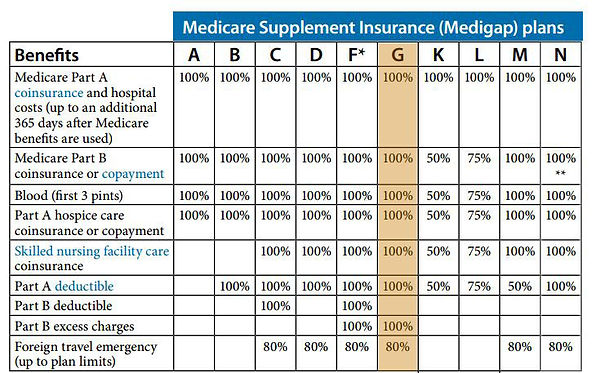

Tip! Medicare Supplement plans (also known as Medigap plans) are available through private insurance companies. They may help pay for Original Medicare costs such as copayments, coinsurance, and deductibles. If you’re enrolled in Original Medicare (Part A and Part B) you may also want to consider purchasing a Medicare Supplement plan.

A chart of the various Medicare Supplement plans is below.

To be eligible to enroll in a Medicare Supplemental Plan D policy, you must be enrolled in Original Medicare (Part A and Part B) and live in the plan's network. The best time to enroll in a Medigap Plan D policy is usually during your six-month Medigap Open Enrollment Period (OEP), which starts the month you're age 65 or older and enrolled in Medicare Part B. During this period, you have the guaranteed issue right to enroll in a Medigap policy of your choosing, meaning that companies may not use medical underwriting to deny you coverage. If you apply for a Medigap plan outside this six-month period, you might be subject to medical underwriting and may be denied coverage if you have a pre-existing health condition. However, there are some situations when you might have guaranteed issue rights to Medigap coverage outside your Medigap OEP.

This website and its contents are for informational purposes only. Nothing on the website should ever be used as a substitute for professional medical advice. You should always consult with your medical provider regarding diagnosis or treatment for a health condition, including decisions about the correct medication for your condition, as well as prior to undertaking any specific exercise or dietary routine.

Additional information:

‣ When does my coverage start?

‣ What changes can I make during the Annual Election Period?